CERTIFIED FINANCIAL ENGINEER

Expertise for professional corporate management and financial planning

The Certified Financial Engineer Program

Our Certified Financial Engineer program offers you the opportunity to take your financial engineering skills to the next level through digital education and practice-oriented case studies. With over 10 years of experience in digital finance education and in cooperation with Deutsche Börse, we show you how to create efficient and transparent models that you can apply directly to your daily work.

- Financial Engineering

- Data Analytics in Quantitative Finance

- Venture Capital and Innovation Finance

- Risk Management

- Current Methods in Corporate Finance

- Derivatives

experience

of our programs

Financial Modeling book

Free information material for the Certified Financial Engineer program

Apply today for the Certified Financial Engineer program and take the next step in your career!

Benefits of the Certified Financial Engineer Certificate

Completion in approx. 4 months – time-independent, location-independent, can be started at any time.

Personal support from experienced professors and access to a strong network.

Content is based on selected textbooks supplemented by coordinated instructional videos and numerous additional materials.

No written exams – you create models and present them professionally.

The modules cover key financial topics, including investment and financing, corporate finance, portfolio management, and derivatives, and are tailored directly to the needs of finance experts.

Step-by-step instructions and modern software.

Access to exclusive alumni and expert networks.

Officially accredited within the framework of the HfWU system accreditation.

The course can be started at any time.

Curriculum

Derivatives

- Course unit 1: How options work, value drivers of options, and the binomial model

- Course unit 2: The Black-Scholes-Merton model including the Greeks

- Course unit 3: Fundamentals and pricing of futures

- Course unit 1: Basic strategies with options and bullish option strategies

- Course unit 2: Bearish option strategies and neutral strategies

- Course unit 3: Deriving a cockpit for selecting a market-appropriate strategy

Risk Management

- Course unit 1: Calculation and presentation of risks

- Course unit 2: Risk metrics

- Course unit 3: EWMA, ARCH, and GARCH models for calculating volatility

- Course unit 1: Different types of Value at Risk and Lower Partial Moments as well as extreme value theory

- Course unit 2: Determining portfolio risks using historical simulation, Monte Carlo simulation, and copula functions

- Course unit 3: Hedging of insurable risks and modeling of non-hedged risks

JOACHIM HÄCKER

- Derivatives

- Risk Management

- Corporate Finance

1 Certificate

2 further graduation options

Certified

Financial

Modeler

Certified Financial Modeler

- Business Plan with Standards and Methods in Financial Modeling

- Company Valuation

- Mergers & Acquisitions, Leveraged Buyout, Private Equity and Initial Public Offering

- Portfolio Management

MBA

Applied

Quantitative

Finance

MBA

Applied

Quantitative

Finance

LEARN MORE

Certified

Financial

Engineer

Certified Financial Engineer

Financial Engineering

- Data Analytics in Quantitative Finance

- Venture Capital and Innovation Finance

- Risk Management

- Current Methods in Corporate Finance

- Derivatives

Information Options

An initial overview of the content, structure, and organization of the Certified Financial Modeler program:

In the info video, the professors concisely present the main features of the Certified Financial Modeler program.

Information on Admission, Registration & Participation Fees

The participation fees for the Certified Financial Engineer are composed as follows:

- Course fees: EUR 3,995 plus VAT, totaling EUR 4,754.05.

- Scholarship: Opportunity to apply for an EIQF scholarship, which reduces the fees to EUR 1,995.00 plus VAT.

- For students: EUR 1,256.30 plus VAT, totaling EUR 1,495.00.

- For students with ECTS: EUR 1,508.40 plus VAT, totaling EUR 1,795.00.

The course fees include examination fees, the course book as an e-book, and access to extensive learning materials.

Basic knowledge of finance and Excel.

Willingness to participate in an intensive, practice-oriented program.

Registration possible at any time

The financial world is undergoing a radical upheaval, characterized by a difficult earnings situation in an environment of increasing competition from innovative companies. Key drivers in this transformation are digitalization and automation, which can be described by technology trends such as Big Data, Blockchain, Machine Learning, or Artificial Intelligence.

Employees with a high affinity for technology and a good understanding of issues at the intersection of finance and IT are in demand.

The program is aimed at…

Finance professionals who want to improve their career opportunities through in-depth knowledge of financial modeling.

Advisors and consultants who want to strengthen their analytical skills and offer their clients sound financial models and analyses.

Bank employees and financial service providers who want to expand their expertise in creating and analyzing complex financial models to open up better professional opportunities.

IT and Data Science experts who want to specialize in financial models and apply their technical skills in the field of financial modeling.

Professionals who want to expand and optimize their consulting services through specialized skills in financial modeling.

Managers and executives who want to make sound financial decisions based on precise models and thereby improve their strategic skills.

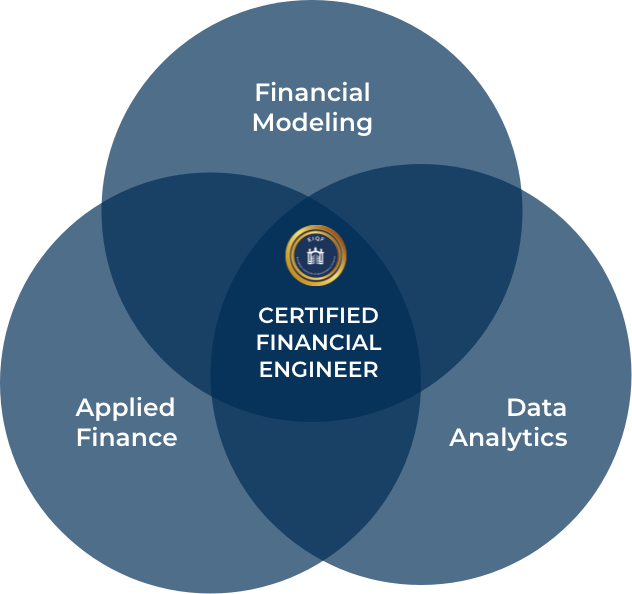

With 10 modules, one might expect them to be taught by 10 different professors. However, behind the 10 modules are exactly 2 professors who have created this teaching content over the last 20 years in the form of successive publications. Using interconnected modules, you will learn how the individual elements of Financial Modeling, Financial Engineering, and Data Analytics are related.

What other quants say about the program

The Certified Financial Engineering program is one of the best learning experiences

I have ever had. It is a well-thought-out course with a practical

focus. I am very satisfied with the training offered by the European Institute of Quantitative Finance

. The training provided is based

entirely on industry projects and practical solutions to real-world problems. The

instructors are competent and have very good knowledge of the industry and

can identify the needs of the students. The guidance provided by the instructors

was excellent, and the overall experience is

very good. If you want to optimize your technical skills, I personally advise you

to participate in the EIQF.

The Certified Financial Engineer program offered by the European Institute of

Quantitative Finance (EIQF) was very useful in my case as it

is well-structured and takes into account the latest developments in the field.

It is largely among the best in the world and represents an

excellent opportunity for theoretical and practical improvement for all participants.

The Certified Financial Engineer emphasizes the importance of knowledge within the financial world. The worldwide regulatory body cannot replace continuous education. It is the depth of the Certified Financial Engineer program that portrays a new picture to participants and sets a whole new standard for the financial community.

The Certified Financial Engineer from the European Institute of Quantitative Finance is a practical training program in the field of derivatives.

In terms of content, it covers valuation methods for options and futures (Binomial, Black-Scholes-Merton model), as well as various strategies (bullish, bearish, and neutral strategies). Thanks to an extensive course book, the content is easy to understand even without prior knowledge.

If you ever get stuck, you will receive helpful support from the professors.

You are very flexible in terms of time, which is why the course can also be completed alongside work.

The course can be credited toward an MBA program.

For anyone who wants to further their education in the field of derivatives, this course is highly recommended.

I really enjoyed the Certified Financial Engineer program because of the practical application in Excel and the excellent knowledge transfer achieved as a result. I was finally able to learn how to work effectively with specialist knowledge about derivatives and create added value, whether for my clients or in my own trading on the markets. This was an excellent technical and practical supplement to the Certified Financial Modeler. The teaching materials were of outstanding quality and valuable content was offered for both fans of videos and the classic textbook. The implementation examples are also true treasures for one's personal repertoire, providing a reference work to fall back on in the future. I also thought the deep financial mathematical theory, which sharpens basic understanding, was great. The investment in this program will certainly achieve a high return!

I really enjoyed the Certified Financial Engineer program because of the practical application in Excel and the excellent knowledge transfer achieved as a result. I was finally able to learn how to work effectively with specialist knowledge about derivatives and create added value, whether for my clients or in my own trading on the markets. This was an excellent technical and practical supplement to the Certified Financial Modeler. The teaching materials were of outstanding quality and valuable content was offered for both fans of videos and the classic textbook. The implementation examples are also true treasures for one's personal repertoire, providing a reference work to fall back on in the future. I also thought the deep financial mathematical theory, which sharpens basic understanding, was great. The investment in this program will certainly achieve a high return!

The Certified Financial Engineer program is excellently suited for improving one's knowledge in the field of derivative financial instruments. The sometimes complex financial mathematical backgrounds are presented very clearly. I would particularly like to highlight the first-class support from the professors. You quickly notice that a lot of effort and passion has gone into the program.

The Certified Financial Engineer program imparts comprehensive knowledge in the field of derivatives and thus contributes significantly to financial education in Germany. The accompanying teaching material leads through the complex financial mathematical subject matter in an understandable and clear manner, so that problem-solving is approached with pleasure. The program is particularly recommended for young professionals, as it can be completed alongside work thanks to its flexible design. The knowledge gained can thus flow directly not only into everyday professional life but also into private wealth accumulation.

FAQ - Certified Financial Engineer

What is the Certified Financial Engineer (CFE)?

Which specializations can be chosen?

Who is the program suitable for?

How is the course structured?

How does the application process work?

Apply today for the Certified Financial Engineer program and take the next step in your career!