MBA Applied

Quantitative Finance

The MBA Applied Quantitative Finance Program

What could the financial world of tomorrow look like? In the age of digitization and AI, we are experiencing major upheavals in the financial sectors of companies, banks, insurance providers, auditing, and consulting firms. These changes offer great opportunities for those who use their skills to help shape this transformation. There is a high demand for financial experts at the intersection of financial modeling, financial engineering, and data analytics. With their quantitative finance knowledge, they not only understand numbers and data but can also translate them into valuable strategies. This is exactly where the MBA in Applied Quantitative Finance comes in.

As a graduate of the MBA Applied Quantitative Finance, you will be perfectly prepared for all innovative topics in the financial sector and possess the skills and competencies to act as a leader.

- Listen as a podcast now

- This audio file was created with the assistance of artificial intelligence.

Free information material for the MBA Applied Quantitative Finance program

Apply today for the MBA Applied Quantitative Finance and take the next step in your career!

Overview

– Part-time MBA: Degree in 4 semesters.

– Digital Studies: Flexible in terms of time and location.

– Teaching Concept: Personal support and instructional videos tailored to our own textbooks.

– Accredited Quality: University-accredited degree program.

– Practical Content: Real-world financial case studies.

– Flexible Start: Winter or summer semester.

Program Structure

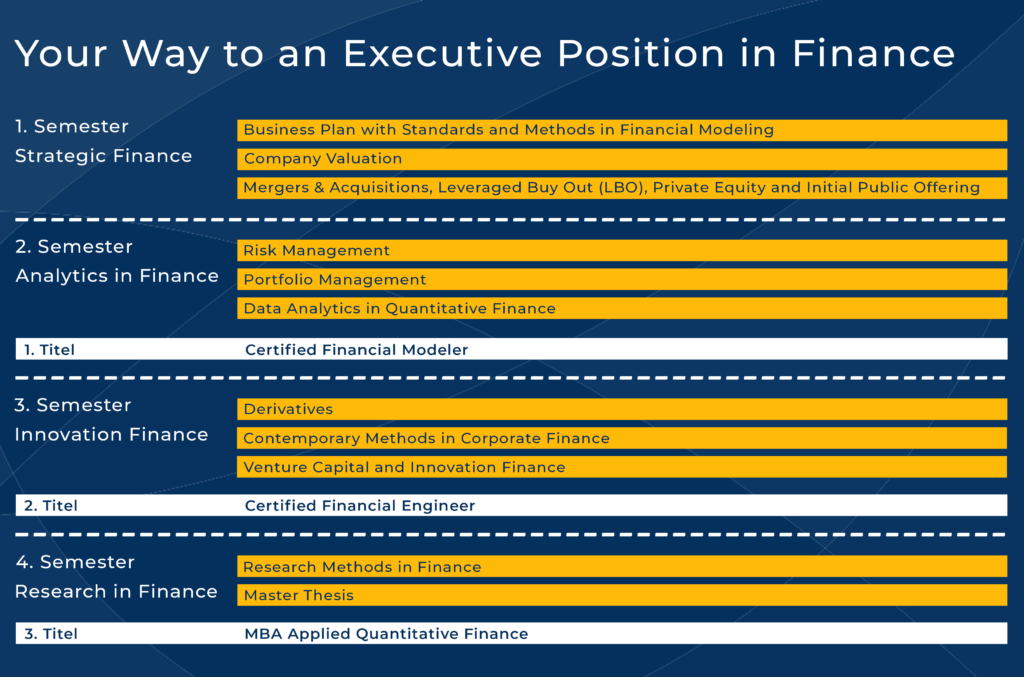

By integrating the certificate qualifications, graduates receive the following 3 titles upon completion of the program:

MBA Applied Quantitative Finance

Certified Financial Engineer

Certified Financial Modeler

Module 1: BUSINESS PLAN WITH STANDARDS AND METHODS IN FINANCIAL MODELING

COURSE 1: Creating a Business Plan

Course Unit 1: Data Collection and Model Preparation

Course Unit 2: Preparation of P and Balance Sheet

Course Unit 3: Preparation of Integrated P and Balance Sheet Planning

COURSE 2: Optimizing a Business Plan

Course Unit 1: Derivation of a Net Cash Flow Statement and Cash Flow Statement

Course Unit 2: Performing Goal Seek Analysis

Course Unit 3: Documentation of the Business Plan

Module 2: COMPANY VALUATION

COURSE 1: Discounted Cash Flow (DCF) Method

Course Unit 1: WACC Approach

Course Unit 2: Period-Specific WACC Approach

Course Unit 3: Sensitivity Analysis

COURSE 2: Multiples

Course Unit 1: Trading Multiples

Course Unit 2: Transaction Multiples

Course Unit 3: Football Field

Module 3: MERGERS ACQUISITIONS, LEVERAGED BUYOUT (LBO),

PRIVATE EQUITY AND INITIAL PUBLIC OFFERING

COURSE 1: Advanced Company Valuation

Course Unit 1: Adjustment of Cost of Capital

Course Unit 2: Performing Company Valuation

Elective: COURSE 2: Mergers Acquisitions, Private Equity and Initial Public Offering

Course Unit 1: Mergers Acquisitions

Course Unit 2: Private Equity and Initial Public Offering

Elective: COURSE 3: LBO Financing

Course Unit 1: Assumptions of LBO Financing

Course Unit 2: Transaction Structure of LBO Financing

Module 4: RISK MANAGEMENT

COURSE 1: Representation of Risk

Course Unit 1: Data Collection and Model Preparation

Course Unit 2: Density Function and Distribution Function

COURSE 2: Modeling Volatility

Course Unit 1: EWMA and GARCH

Course Unit 2: Forecasting Value and Price Developments Using Stochastic Processes

Course Unit 3: Calculation of Portfolio Risk

COURSE 3: Risk Measures

Course Unit 1: Variance and Standard Deviation

Course Unit 2: Skewness and Kurtosis

Course Unit 3: VaR Variants for Discrete and Continuous Distributions

Course Unit 4: VaR Variants Using Extreme Value Theory

Course Unit 5: Value at Risk for Non-Linear Price Functions: Bonds

COURSE 4: Simulations

Course Unit 1: Historical Simulation

Course Unit 2: Monte Carlo Simulation

Module 5: PORTFOLIO MANAGEMENT

COURSE 1: Markowitz Portfolio Selection

Course Unit 1: Return Calculation

Course Unit 2: Calculation of Portfolio Risk in the 2-Asset Case

Course Unit 3: Calculation of Portfolio Risk in the n-Asset Case

COURSE 2: Portfolio Optimization

Course Unit 1: Absolute Optimization

Course Unit 2: Relative Optimization

Module 6: DATA ANALYTICS

COURSE 1: Data Analytics with ORANGE

Course Unit 1: Statistical Fundamentals with ORANGE

Course Unit 2: Forecasting Models with ORANGE

Course Unit 3: Data Prediction and Classification Possibilities Using Deep Learning

COURSE 2: Project: Data Analytics

Course Unit 1: Application Fields of Data Analytics

Course Unit 2: Benford’s Law and Last Digit Approach

Course Unit 3: The Application of Python in Company Valuation

Module 7: DERIVATIVES

COURSE 1: Option Pricing

Course Unit 1: Option Pricing with the Binomial Model

Course Unit 2: Option Pricing with the Black-Scholes-(Merton) Model (incl. Greeks)

COURSE 2: Option Strategies

Course Unit 1: Basic Strategies with Options and Bullish Option Strategies

Course Unit 2: Bearish Option Strategies and Neutral Strategies

Course Unit 3: Application of the Created Model to the Current Market Situation

Module 8: CONTEMPORARY METHODS IN CORPORATE FINANCE

COURSE 1: Unbiased Planning

Course Unit 1: Modeling Monte Carlo Risk Parameters

Course Unit 2: Modeling Unbiased P, Balance Sheet, and Cash Flow Statements

Course Unit 3: Modeling Probability of Default

Course Unit 4: Modeling Unbiased Cash Flow to Equity with Probability of Default

COURSE 2: Simulation-Based Company Valuation

Course Unit 1: Risk Analysis of Simulated Cash Flow to Equity

Course Unit 2: Derivation of Cost of Equity from Risk Analysis

Course Unit 3: Valuation of the Company Using the Equity Approach and the Risk-Adjusted Discount Rate Method

Course Unit 4: Valuation of the Company Using the Equity Approach and the Certainty Equivalent Method

Module 9: VENTURE CAPITAL INNOVATION FINANCE

COURSE 1: Real Options in Investment Banking

Course Unit 1: Introduction to Real Options: Real Options and Financial Options

Course Unit 2: Real Options in Mergers Acquisitions

Course Unit 3: Real Options in Venture Capital and Initial Public Offering

COURSE 2: Case Study on Compound Real Options

Course Unit 1: Derivation of Free Cash Flows and Calculation of Net Present Value

Course Unit 2: Derivation of the Value Development Tree and Representation of Possible Project Value States

Course Unit 3: Derivation of Option Values

1 Degree Program

3 Certificates

Certified

Financial

Modeler

Certified Financial Modeler

- Business Plan with Standards and Methods in Financial Modeling

- Company Valuation

- Mergers Acquisition, Leveraged Buyout, Private Equity and Initial Public Offering

- Portfolio Management

MBA

Applied

Quantitative

Finance

MBA

Applied

Quantitative

Finance

LEARN MORE

Certified

Financial

Engineer

Certified Financial Engineer

- Data Analytics in Quantitative Finance

- Venture Capital and Innovation Finance

- Risk Management

- Current Methods in Corporate Finance

- Derivatives

Our holistic concept is the result of over 20 years of experience in the field of quantitative finance. Become part of the next generation of quants.

The program is designed so that you can easily complete it alongside your job. This allows you to apply what you have learned directly in professional practice.

Our students receive personal support from our team of professors. You benefit from years of experience and an enormous professional network.

You model the entire world of finance based on a company of your choice.

You work on case studies and create models used in practice and research.

You create models and defend them. No written exams or rote memorization required.

With the MBA, there is the possibility of pursuing a doctorate. Our DBA offers a perfect follow-up to the MBA Applied Quantitative Finance. The same two directors who guided you through the MBA will supervise your doctoral thesis.

Information Options

Do you have questions about the application, program sequence, or content?

Detailed information about the MBA Applied Quantitative Finance is available at our regular online info evenings with the program director Prof. Dr. Dietmar Ernst. Next dates:

- Coming soon here

Would you like a personal consultation to clarify open questions?

Appointments for a free consultation with the scientific director Prof. Dr. Joachim Häcker can be arranged directly via email.

Would you like to get to know the program better?

You can get an initial overview of the content, structure, and organization of the MBA Applied Quantitative Finance through our info presentation.

Would you like to have the program presented in a detailed lecture without the stress of an appointment?

In the info video, our program director Prof. Dr. Dietmar Ernst, together with the scientific director Prof. Dr. Joachim Häcker, concisely presents the main features of the MBA Applied Quantitative Finance.

The financial world is undergoing a radical upheaval, characterized by a difficult earnings situation in an increasingly competitive environment of innovative companies.

Key drivers in this transformation are digitization and automation, which can be described by technology trends such as Big Data, Blockchain, Machine Learning, or Artificial Intelligence. Employees with a high affinity for technology and a good understanding of issues at the intersection of finance and IT are in demand.

Finance professionals who want to improve their career opportunities through in-depth knowledge of financial modeling.

Advisors and consultants who want to strengthen their analytical skills and offer their clients sound financial models and analyses.

Bank employees and financial service providers who want to expand their competence in creating and analyzing complex financial models to open up better professional opportunities.

IT and data science experts who want to specialize in financial models and apply their technical skills in the field of financial modeling.

Professionals who want to expand and optimize their consulting services through specialized skills in financial modeling.

Managers and executives who want to make sound financial decisions based on precise models and thereby improve their strategic skills.

With 10 modules, one might expect them to be taught by 10 different professors. However, behind the 10 modules are exactly 2 professors who have created this teaching content over the last 20 years in the form of sequential publications. Through interconnected modules, you will learn how the individual elements of financial modeling, financial engineering, and data analytics relate to each other.

What other quants say about the program

Choosing the MBA Applied Quantitative Finance was exactly the right decision – a program independent of location and time with a focus on practical case studies and current topics from the financial world, which offers me new perspectives both professionally and personally.

“I was a bit skeptical about doing a full MBA online. However, I found the innovative course concept with many personal learning opportunities brilliant and very meaningful.

The case study structure helped break down the vast theory surrounding quantitative finance into steps and test my practical knowledge with real case examples.

I particularly liked the flexible design, which allowed me to fit my studies around my professional activities.”

“The MBA Applied Quantitative Finance is the ideal solution for those who want to continue their education in the finance sector with a high-quality Master's degree alongside their job and still not give up any private passion/hobby. Working on the various case studies without fixed lecture dates allows the student a flexible and independent allocation of the learning effort throughout the entire semester. Thanks to this model, I can still play handball to the same extent as I did before starting the MBA.”

“The Master's program 'Applied Quantitative Finance' immediately caught my eye when choosing a Master's. The possibility of obtaining three degrees and the connection of the modules in a holistic structure convinced me. As a Master's student, I can emphasize the support from the two professors, the flexibility to work through the study content, and the easily understandable literature as an example of excellent teaching in the digital age. I am completely satisfied and happy to recommend the Master's to anyone who wants to get fit for the challenges in the finance sector.”

Admission Registration Deadlines

- Registration Form

- Further Information (Funding Opportunities)

- External Examination Regulations (EPO)

- Cancellation Policy and Cancellation Form (PDF)

- First university degree (Bachelor with at least 180 ECTS or equivalent) regardless of the field of study

- Qualified professional experience of at least 1 year, whereby internship/practical periods from the first degree, working student activities on a full-time pro-rata basis, and professional activity before a first degree are recognized

- Both admission requirements are met through a dual study program

- Registration for the MBA for the winter semester is possible until September 15

- Registrations for certificate courses from the first and second semesters are possible year-round, up to 2 weeks before the start of the course. Modules from the 3rd semester cannot be taken as certificate courses.

Degree

System-accredited study program for the MBA in Applied Quantitative Finance at HfWU, one of the leading state universities of applied sciences (HaW). The program lasts four semesters. After successful completion of 10 modules including the Master’s thesis and proven 300 ECTS, the degree formally fulfills the requirements for a doctoral project.

System-accredited study program for the MBA in Applied Quantitative Finance at HfWU, one of the leading state universities of applied sciences (HaW). The program lasts four semesters. After successful completion of 10 modules including the Master’s thesis and proven 300 ECTS, the degree formally fulfills the requirements for a doctoral project.

The Master’s offering at the Nürtingen-Geislingen University of Applied Sciences (HfWU) in business degree programs performed brilliantly in the current university ranking. HfWU is among the top ten universities of applied sciences in Germany. The CHE ranking is the most comprehensive university assessment in the German-speaking world. Top marks were given here for the general study situation and the range of courses. In addition, the degree programs performed very well in the categories of contact with professional practice and degree completion within a reasonable time.

We offer studying at a top level at a highly respected state university as part of our part-time MBA in Applied Quantitative Finance. This innovative degree program is based on real case studies, can be studied regardless of time and location, and perfectly prepares all students for exciting and current topics in the financial sector.

Certificate Courses

The two certificate courses of the European Institute of Quantitative Finance are integrated into the MBA Applied Quantitative Finance.

After successful completion of the first semester and the module “Financial Modeling in Portfolio Management,” you will receive the title “Certified Financial Modeler.”

After successful completion of the third semester, you will obtain the title “Certified Financial Engineer.”

After successful completion of the fourth semester, you will graduate with the MBA.

Additionally, your achievements are creditable towards the MBA Applied Quantitative Finance as part of “Academic Excellence.”

For the successful completion of the Certified Financial Modeler and the Certified Financial Engineer, you will receive 8 ECTS each.

We will credit you up to 16 ECTS for the MBA Applied Quantitative Finance. This reduces the total cost of the course from €14,592 to €12,000 if you have completed both certificates (or €13,296 if you have completed one of the two certificates).

With this mutual credit, you have the opportunity to get a taste of the MBA Applied Quantitative Finance. As a student, you only pay €1,795 for the Certified Financial Modeler or Certified Financial Engineer program. This way, you can ensure that our holistic and digital learning concept of the EIQF is exactly right for you. Regardless of which path you choose, you will acquire three attractive titles upon completion of the degree program.

Participation Fees

The participation fees for the MBA Applied Quantitative Finance

(4 semesters) are 14,592 EUR (VAT-free).

The fees are to be paid in 24 monthly installments of 608 EUR via standing order without deduction.

One-time after registration: 50 EUR processing fee

One-time upon admission: 300 EUR admission fee

In addition, there is a one-time examination fee of currently: 200 EUR.

For exclusive participation in the certificate courses Certified Financial Modeler and Certified Financial Engineer, a one-time fee of EUR 1,795 (incl. VAT) each is currently due.

Information on funding opportunities is provided by our HfWU Academy under the point “Financing Options.”

HfWU has successfully undergone system accreditation by the Accreditation Council.

This certified the university’s own system for quality assurance in teaching and learning, AQAS. These certificate courses are in turn credited towards the MBA Applied Quantitative Finance, and the participation fees are reduced accordingly.

The Applied Quantitative Finance study program has successfully completed all stages of this quality assurance system according to the corresponding requirements and is accredited on this basis. Thus, it is subject to

continuous and systematic quality monitoring.

The further development of the program is supported and ensured by an advisory board composed of high-ranking representatives from science and practice.

The MBA Applied Quantitative Finance was approved by the State Central Office for Distance Learning (ZFU) on July 2, 2021, under approval number 111 8321.

What does the MBA Applied Quantitative Finance offer?

What makes the MBA special?

How is the MBA structured?

How high are the costs?

How long does the MBA take?

What career opportunities does the MBA open up?

How can I apply?

Apply today for the MBA Applied Quantitative Finance and take the next step in your career!