FINANCIAL MODELING

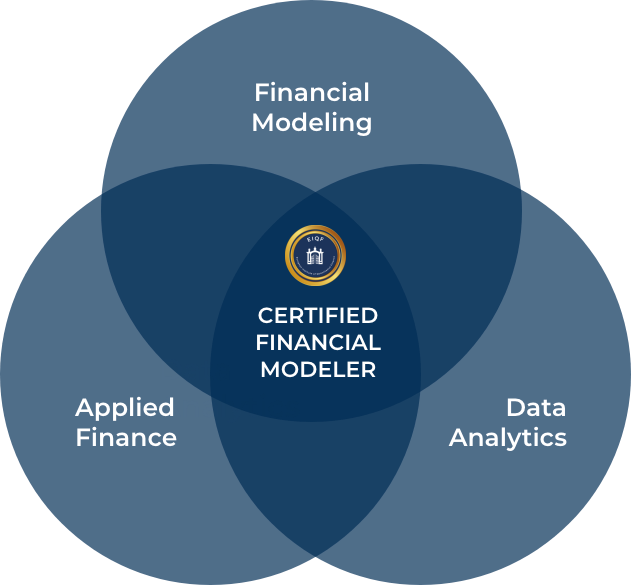

CERTIFIED FINANCIAL MODELER

Qualification for professional corporate planning

The Certified Financial Modeler Program

Our Certified Financial Modeler program provides you with practical, digital training in the essential skills needed to create and apply professional financial models.

- Financial Modeling

- Business Plan with Standards and Methods in Financial Modeling

- Company Valuation

- Mergers & Acquisition, Leveraged Buyout Private Equity and Initial Public Offering

- Portfolio Management

Experience

of our programs

Financial Modeling book

The Certified Financial Modeler Program

Experience the world of financial modeling! Our Certified Financial Modeler program offers you the opportunity to elevate your financial modeling skills to a new level through digital financial education and practice-oriented case studies. With more than 15 years of experience in digital financial education, we show you how to build models efficiently and transparently that you can apply directly in your daily work.

Free information materials on the Certified Financial Modeler program

Apply today for the Certified Financial Modeler program and take the next step in your career!

Benefits of the Certified Financial Modeler Certificate

Completion in approximately 4 months – time-independent, location-independent, start anytime.

Personal assistance from experienced professors and access to a strong network.

Content based on the renowned textbook “Financial Modeling” – complemented by coordinated instructional videos.

Work on real case studies: P, balance sheet, DCF, scenario analyses, company valuation, and much more.

No written exams – you create models and present them professionally.

Step-by-step instructions and modern software for transparent, efficient modeling.

High advancement opportunities in finance, controlling, and management roles.

Access to exclusive alumni and expert networks.

Officially accredited within the framework of the system accreditation of HfWU.

The program can be started at any time.

Curriculum

“Creating an integrated P and balance sheet plan”

- Creating and formatting a financial model

- Key performance indicator analysis of the profit and loss statement (P) and balance sheets of the last 3 years

- Forming assumptions for planning the P and balance sheet

- Creating an integrated P and balance sheet plan using the Top 10 Financial Modeling Standards

- Creating a planned cash flow statement

- Performing control calculations and plausibility checks

- Verifying the robustness of the financial model through dynamic data validation, goal seek with Solver, sensitivity and scenario analysis

- Documenting the financial model in accordance with Financial Modeling Standards

“Company valuation, investment and financing, and portfolio management”

- Deriving the beta factor and cost of capital

- Calculating free cash flow

- Calculating enterprise value (market value of equity) using discounted cash flow approaches

- Deriving market capitalization

- Determining the book value of equity

- Calculating the market value of equity using transaction multiples

- Presenting the results of the company valuation with a football field chart

- Highlighting key elements of a binding and non-binding offer

- Analyzing finance topics from a capital market perspective

- Understanding the “risk/return” investment framework

- Demonstrating acquisition financing with loans and/or bonds

JOACHIM HÄCKER

1 certificate

2 additional completion options

Certified

Financial

Modeler

Certified Financial Modeler

- Business Plan with Standards and Methods in Financial Modeling

- Company Valuation

- Mergers Acquisition, Leveraged Buyout Private Equity and Initial Public Offering

- Portfolio Management

MBA

Applied

Quantitative

Finance

MBA

Applied

Quantitative

Finance

LEARN MORE

Certified

Financial

Engineer

Certified Financial Engineer

- Data Analytics in Quantitative Finance

- Venture Capital and Innovation Finance

- Risk Management

- Current Methods in Corporate Finance

- Derivatives

Our holistic concept is the result of over 20 years of experience in quantitative finance. Become part of the next generation of quants.

The certificate program is designed so that you can complete it alongside your professional work. This allows you to apply what you have learned directly in professional practice.

Our participants are personally supervised by our team of professors. You benefit from many years of experience and an enormously large professional network.

The modules cover central finance topics. You create a business plan with integrated P, balance sheet, and cash flow planning, a company valuation with DCF, multiples, sensitivity and scenario analyses, as well as corporate financing.

The content is based on the renowned textbook "Financial Modeling," which is widely recognized in the financial world. Additionally, there are customized instructional videos and extensive supplementary materials.

You create models and defend them. No written exams or memorization required.

Access to an exclusive network of finance experts and alumni that offers valuable contacts and exchange opportunities.

Information options

An initial overview of the content, structure, and organization of the Certified Financial Modeler:

In the information video, the professors present the fundamentals of the Certified Financial Modeler concisely.

Information on admission, registration participation fees

The participation fees for the Certified Financial Modeler are as follows:

The program fees include examination fees, the course textbook as an e-book, and access to extensive learning materials.

Basic knowledge of finance and Excel.

Willingness to participate in an intensive, practice-oriented program.

Registration possible at any time

The financial world is undergoing a radical transformation, characterized by a challenging earnings situation in an increasingly competitive environment of innovative companies.

Key drivers of this transformation are digitalization and automation, which can be described through technology trends such as big data, blockchain, machine learning, or artificial intelligence.

Employees with high technology affinity and a good understanding of issues at the intersection of finance and IT are in demand.

The program is aimed at…

Finance professionals who want to improve their career prospects through in-depth knowledge of financial modeling.

Advisors and consultants who want to strengthen their analytical skills and offer their clients well-founded financial models and analyses.

Bank employees and financial service providers who want to expand their competence in creating and analyzing complex financial models to unlock better professional opportunities.

IT and data science experts who want to specialize in financial models and apply their technical skills in the field of financial modeling.

Professionals who want to expand and optimize their consulting services through specialized skills in financial modeling.

Managers and executives who want to make well-founded financial decisions based on precise models and thereby improve their strategic capabilities.

With 10 modules, one might expect them to be taught by 10 different professors. However, behind the 10 modules are exactly 2 professors who have created this curriculum over the last 20 years in the form of successive publications. Through interconnected modules, you learn how the individual elements of financial modeling, financial engineering, and data analytics are related.

The Certified Financial Modeler program helps to map quantitative and qualitative aspects of simple and complex financial issues in Excel VBA-based modules. These modules are helpful for all experts in daily business. The Certified Financial Modeler helps students, juniors, and seniors understand what is important and needed in the field of financial modeling and valuation.

For those responsible for investor relations, the Certified Financial Modeler is an excellent opportunity to acquire and document knowledge in financial modeling.

The Certified Financial Modeler program gives me a better and more focused understanding of complex financial topics. The Excel and VBA-based Certified Financial Modeler philosophy helps me structure almost any financial question and approach a solution.

Certified Financial Modeler – The admission ticket to investment banking. I really must say: "The Certified Financial Modeler professionals are well prepared for their analyst and associate years in investment banking."

The training in the Certified Financial Modeler program provides profound knowledge in the areas of corporate finance, portfolio management, and derivatives. These are deepened and explained through self-study based on theoretical foundations with practical case studies. This divides the complex overall topic into manageable and comprehensible structures. The insights and solution approaches can therefore be directly applied to numerous practical issues.

What is the Certified Financial Modeler (CFM)?

What content does the Certified Financial Modeler program cover?

Who is the Certified Financial Modeler program suitable for?

How long does the program take?

How do I register for the Certified Financial Modeler program?

Apply today for the Certified Financial Modeler program and take the next step in your career!