Fields of activity

Our degrees

Certified Financial Engineer

In the Certified Financial Engineer program, you develop an optimal options strategy to hedge your portfolio or enhance performance. Depending on your choice, you calculate volatility using the EWMA, ARCH, or GARCH models and determine portfolio risks using various simulations. You also learn how simulation-based company valuation can adequately reflect the risks in a business plan.

Certified Financial Modeler

In the Certified Financial Modeler program, you derive the projected income statement, projected balance sheet, and projected cash flow statement from past financial statements. You prepare a company valuation and identify the impact that various financial management activities—such as issuing a bond—have on your model. You learn how to represent reality in a simplified way in an Excel model.

Advisory

Our theoretical models are tested in practice. We act as experts in the field of "company valuation" and perform pricing for a wide range of underlying assets. We are the specialist software used in business practice where standard software reaches its limits.

Bachelor’s

In the "Financial Management" bachelor’s program, you study the fundamentals of financial management and then apply them in your specialization, either in investment banking or real estate. The entire program is independent of location and time and is based on real case studies. This program helps you advance your career by acquiring all modeling-based competencies for a successful role in investment banking or the real estate sector.

MBA

In the MBA in Quantitative Finance, you learn the content of the Certified Financial Modeler as well as the Certified Financial Engineer. Both certificates can also be credited toward the MBA. In addition, you conduct analyses in the context of data science and learn about the latest innovations in finance. Across 9 modules, you explore a broad spectrum of quantitative finance through a continuous case study.

DBA

In the DBA program (Doctor of Business Administration), you have the opportunity to earn a doctoral degree after completing the MBA. Under the supervision of Prof. Dr. Dr. Häcker and Ernst, you expand your expertise and engage intensively with advanced research methods and practice-oriented problem statements.

Research

Research is the foundation of our successful work at EIQF. Here you will find all our publications (textbooks, specialist articles, and academic contributions) as well as the associated models.

MBA Applied Quantitative Finance

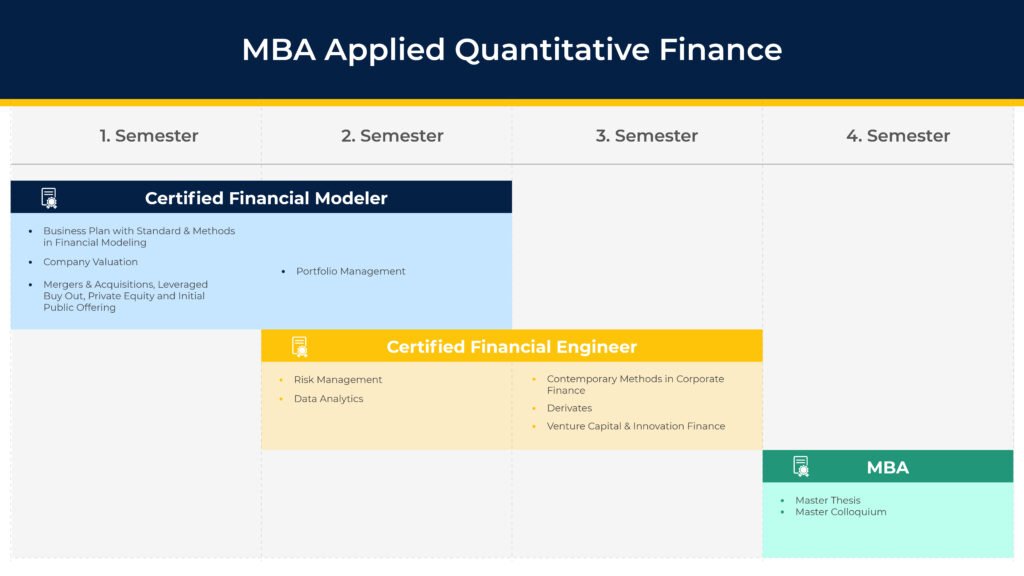

The MBA Applied Quantitative Finance is a 2-year, part-time, system-accredited, modular program leading to the Master of Business Administration (MBA). The program can be studied independently of location and time. It does not require on-site attendance; instead, it is completed by working on practical case studies.

By integrating the certificate qualifications, graduates receive the following 3 titles upon completion of the program:

– MBA Applied Quantitative Finance

– Certified Financial Engineer

– Certified Financial Modeler

Students can acquire in-depth competencies in

Financial Engineering, Financial Modeling, and Data Analytics

that qualify them exceptionally well for future-oriented specialist and leadership positions

in an increasingly digitalized world of work.

Financial Modeling

You will learn to comprehensively capture and solve key financial questions using computer programs such as Excel. You will then be able to represent reality in a simplified and structured way in a balance-sheet-oriented model and derive a basis for decision-making for your strategy.

Financial Engineering

You will learn to comprehensively capture and solve complex financial questions using more advanced computer programs. In doing so, you will use tools such as Risk Kit, Orange, Python, or, as needed, Matlab. Your models are mostly based on capital-market-oriented data.

Master’s Thesis

You apply our approach of so-called financial-modeling-based financial engineering to a case from your professional environment or area of interest. In doing so, you apply the rules of academic work.

*Within the MBA Applied Quantitative Finance, the topics listed in the Certified Financial Modeler and Certified Financial Engineer are covered in significantly greater depth than in the two certificates. However, both certificates can be credited toward the MBA Applied Quantitative Finance. One of the nine modules listed here is credited per certificate. Depending on the focus, the Certified Financial Modeler is credited, for example, with the module “Company Valuation” and the Certified Financial Engineer, for example, with the module “Derivatives”. Regardless of this, every MBA student is awarded the title Certified Financial Modeler after passing the 2nd semester, the title Certified Financial Engineer after passing the 3rd semester, and the MBA after passing the 4th semester.

Apply today and take the next step in your career!